Refinancing gives you the ability to tailor your loan term to suit your situation, subject to serviceability.

Typically a new loan term is 30 years, but there is no reason it cannot be shorter.

Generally, irrespective of your choice of loan terms all have the same interest rate.

The shorter the loan term, the faster you need to pay down the principal and therefore the higher your monthly repayments.

Your loan term is the maximum amount of time you have to pay off a loan, but you can always pay off a loan sooner

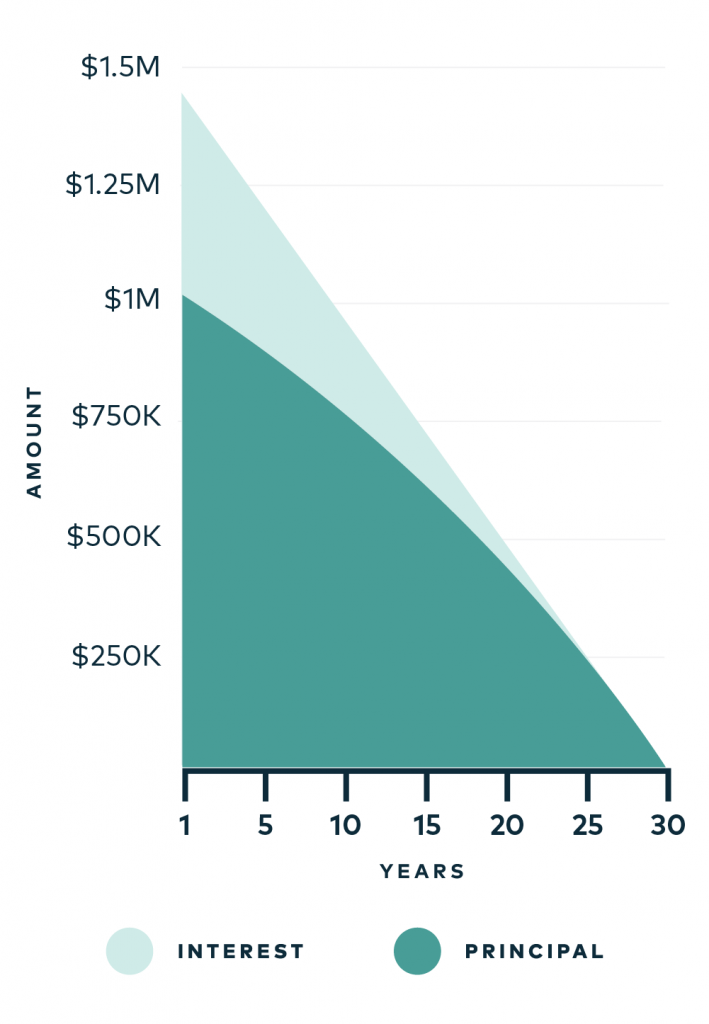

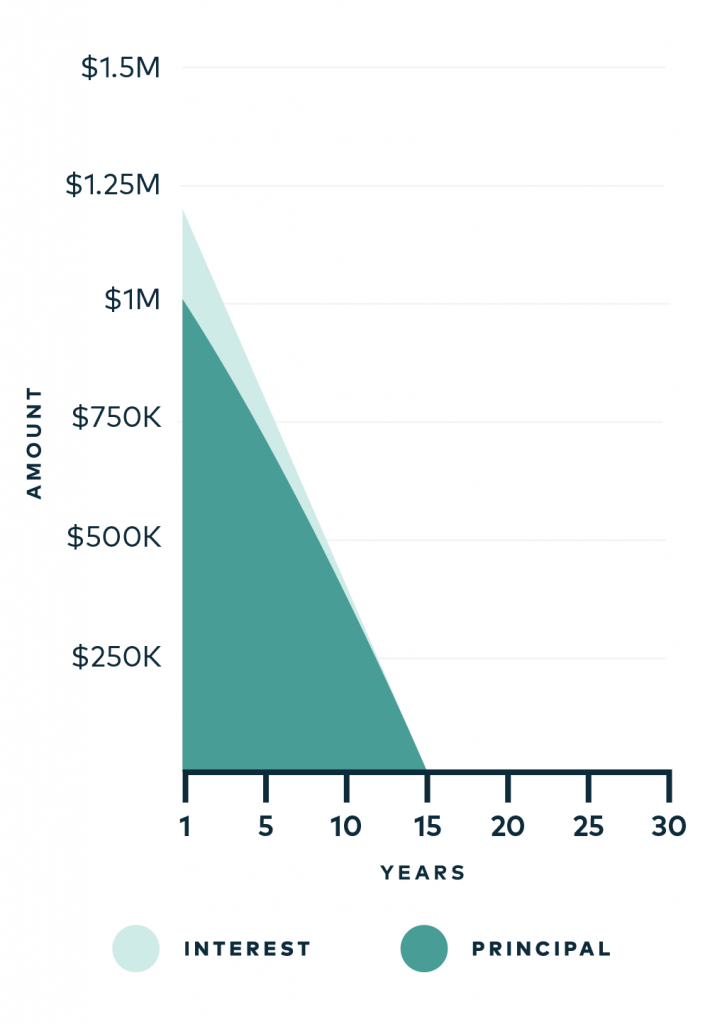

Amount still to pay ($) vs. time (years)

at a rate of 2.50%

15 year term

Decreasing your loan term will increase your monthly repayments, but also reduce the interest payable over the life of your loan.

The additional repayment amount on a shorter loan term is paying down the principal balance of your loan faster and hence increasing the equity in your property.

For older age borrowers, a shorter loan term may be required as you approach retirement to satisfy lender requirements.

Decreasing a loan term too far and hence increasing the required monthly repayment may impact your lifestyle or ability to invest.

Some people like the idea of a shorter loan term as a form of “forced savings”.

30 year term

A longer loan term will reduce your monthly repayments but will increase total interest cost over the life of the loan.

If you have more productive uses of funds than paying down your mortgage such as investment, then a longer loan term may not be as financially fruitful if it eats into these additional funds.

Keeping a longer loan term, paired with an offset account will allow you to have the benefit of lower monthly repayments whilst having the flexibility to make additional repayments as and when you chose whilst maintaining access to those funds.